additional net investment income tax 2021

That means you could pay up to 37 income tax depending on your federal income tax bracket. Stay in a low tax bracket.

What You Need To Know About Capital Gains Tax

B the excess if any of.

. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. April 28 2021 The 38 Net Investment Income Tax. The investment income above the 250000 NIIT threshold is taxed at 38.

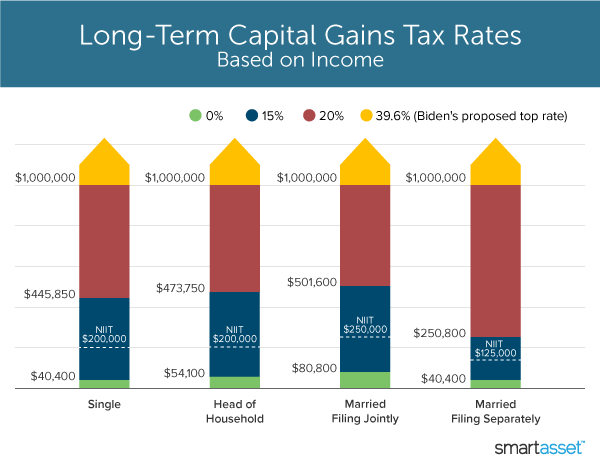

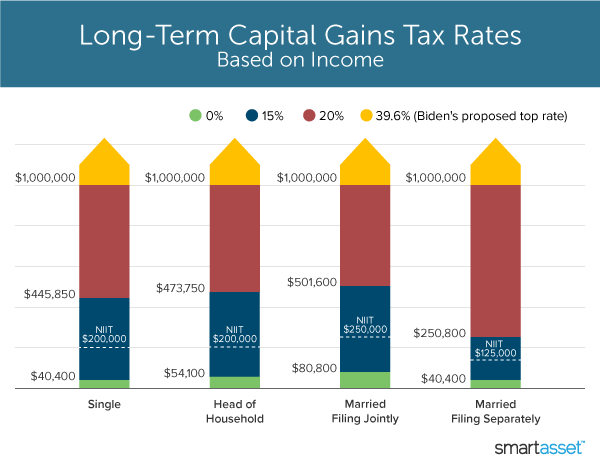

Single or head of household 200000. Single taxpayers with taxable income of 41675 or less in 2022 qualify for a 0 tax rate on qualified dividends and capital gains. This tax is also known as the net investment income tax NIIT.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The threshold amounts are based on your filing status. Such owners may also be able to avoid the additional 09 Medicare tax that applies to wages and.

In addition to the individual income tax high-income taxpayers face two taxes on certain types of income above specified thresholds. Your net investment income is less than your MAGI overage. A the undistributed net investment income or.

If the taxpayer receives a salary from the firm however that income would be subject to the Additional Medicare Tax The Treasury Department has estimated that in 2013. Youll owe the 38 tax. After 11302022 TurboTax Live Full Service customers will be able to amend their.

The Net Investment Income Tax NIIT or Medicare Tax is a 38 Surtax imposed by Section 1411 of the Internal Revenue Code on investment income. The full credit can be claimed by married joint filers with modified. Married filing jointly or qualifying.

Mark Topic as New. In the case of an estate or trust the NIIT is 38 percent on the lesser of. The investment income tax is a surtax of 38 in addition to the regular income tax that certain.

2021 Capital Gains Tax Rates and. 2022-01-07 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. Mark Topic as Read.

2021 Federal Income Tax Brackets. Overview Data and Policy Options. Today revenue from the net investment income tax goes to the US.

Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year. A Married Filing Jointly household has 300000 in income from self-employment and.

Net Investment Income Tax. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year over the. The adjusted gross income.

The firstthe additional Medicare taxis a. Net Investment Income Tax. The child tax credit for 2021 is 3600 for each child under age 6 and 3000 for each child ages 6 to 17.

Net Worth Calculator Balance Sheet Assets And Liabilities Excel Spreadsheet For Property Investors And Small Business Digital Download

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Income Tax Law Changes What Advisors Need To Know

Self Employment Tax Rate Higher Income Investing Freelance Income

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The The Net Investment Income Tax Niit Forbes Advisor

Form 8615 Tax For Certain Children With Unearned Income Jackson Hewitt

What You Need To Know About Capital Gains Tax

Sources Of Personal Income In The United States Tax Foundation

What S In Biden S Capital Gains Tax Plan Smartasset

What Is Investment Income Definition Types Tax Treatments

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)